I’m expecting to receive some funds to invest in my Stocks and Shares ISA. So at present I’m building a shortlist of the best UK growth stocks that money can buy.

Here are two small-cap stocks I’m considering spending £2,000 on.

A high-energy share

Demand for nuclear power is tipped to soar over the coming decades. Energy consumption is rising sharply in fast-growing emerging markets. And governments are ramping up efforts to replace dirtier fossil fuels with low-carbon sources of energy.

This is why I’m considering buying shares in AIM-quoted Aura Energy (LSE:AURA). This UK share owns the Tiris uranium-vanadium resource in Mauritania along with the Häggån project in Sweden which contains uranium, vanadium and potash.

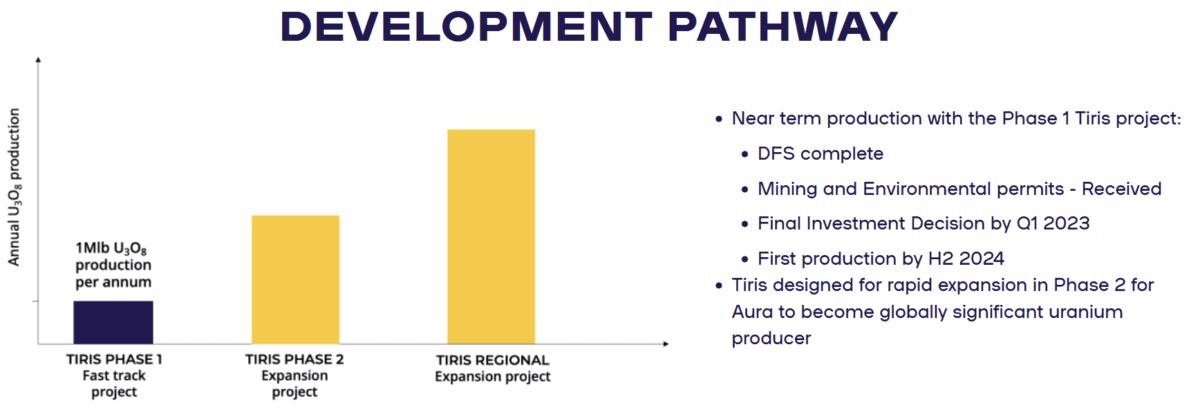

I’m most excited about Tiris where production is slated to begin in 2024. First production here is scheduled for next year and the business plans to rapidly scale up production to exploit soaring uranium demand.

Resource upgrades

I’m especially upbeat about Aura Energy following recent testing at Tiris. Last month, the miner said that measured and indicated resources had increased by a bumper 52%. This could lead to a hike in production targets.

Getting new mining projects off the ground can be problematic and expensive business. Therefore the road to first production at Tiris next year could be a bumpy one. But on balance, I think the benefits of buying this small-cap share are likely to outweigh the risks.

Uranium demand is forecast to soar to 206m pounds by 2030 and then to 292m pounds a decade later. That’s up from 162m pounds in 2021, according to the World Nuclear Association. Yet, over the same period, supply of the radioactive material is tipped to fall due to a lack of new mines.

In this scenario, the price Aura Energy charges for its product is likely to surge. This could make the business an impressive growth share for the coming decades.

Another top mining stock

Like uranium, copper is also expected to endure a price-supporting market deficit in the years ahead. This is why I’m tempted to buy shares in Anglo Asian Mining (LSE:AAZ) for my ISA too.

This small-cap UK stock produces the red metal — along with gold and silver — from its assets in Azerbaijan. And it plans to pivot its operations more closely to copper from this year as it supercharges output.

Anglo Asian Mining expects to produce 4,100-4,300 tonnes of the industrial commodity in 2023, up from 2,516 tonnes last year. I’m tempted to buy the AIM share even though copper prices could fall in the near term as the global economy cools.

Thanks to themes like rising urbanisation and the growth of green technologies, demand for copper is expected to balloon over the long term. This could power profits at copper stocks like Anglo Asian Mining through the roof.